It takes a few minutes, but the best way to quote cheaper car insurance rates is to start doing an annual price comparison from insurance carriers who sell auto insurance in Memphis.

- Step 1: Spend some time learning about what is in your policy and the measures you can control to prevent high rates. Many things that result in higher rates such as traffic citations, accidents, and an imperfect credit score can be eliminated by making small lifestyle or driving habit changes.

- Step 2: Quote rates from independent agents, exclusive agents, and direct companies. Direct companies and exclusive agencies can only give prices from one company like Progressive or Farmers Insurance, while independent agencies can quote prices for a wide range of insurance providers.

- Step 3: Compare the new quotes to your existing coverage to see if a cheaper price is available. If you find a lower rate quote and make a switch, make sure coverage is continuous and does not lapse.

- Step 4: Provide notification to your current agent or company to cancel your current coverage and submit a down payment along with a completed application for your new coverage. Don’t forget to keep your new certificate verifying coverage in a readily accessible location in your vehicle.

A good tip to remember is to make sure you enter similar coverage information on every quote and to quote with every company you can. This guarantees a fair rate comparison and a complete rate analysis.

Everyone knows that insurance companies don’t want customers comparing rates. Drivers who get comparison quotes at least once a year will most likely switch companies because the odds are good of finding a cheaper policy. A recent survey discovered that consumers who compared rate quotes regularly saved an average of $865 a year compared to policyholders who don’t make a habit of comparing rates.

Everyone knows that insurance companies don’t want customers comparing rates. Drivers who get comparison quotes at least once a year will most likely switch companies because the odds are good of finding a cheaper policy. A recent survey discovered that consumers who compared rate quotes regularly saved an average of $865 a year compared to policyholders who don’t make a habit of comparing rates.

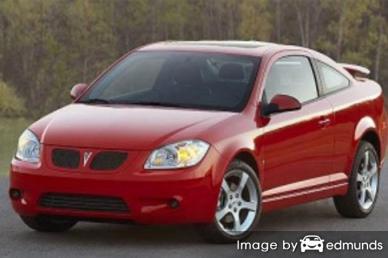

If saving money on Pontiac G5 insurance in Memphis is your ultimate target, then having some knowledge of how to find and compare cheaper coverage can help you succeed in finding affordable rates.

The quickest way to compare insurance rates in your area is to realize car insurance companies participate in online systems to compare their rates. All consumers are required to do is provide a little information like types of safety features, daily mileage, if you went to college, and whether you are married. Those rating factors is instantly submitted to all major companies and they provide comparison quotes quickly.

To find lower lower-cost Pontiac G5 insurance rates now, click here and see if a lower rate is available in Memphis.

The providers in the list below have been selected to offer quotes in Tennessee. To locate the best cheap auto insurance in TN, we recommend you visit as many as you can to get the most affordable price.

Insurance does more than just protect your car

Even though it’s not necessarily cheap to insure a Pontiac in Memphis, insurance is a good idea for several reasons.

First, just about all states have compulsory liability insurance requirements which means you are required to buy a specific minimum amount of liability insurance coverage in order to license the vehicle. In Tennessee these limits are 25/50/15 which means you must have $25,000 of bodily injury coverage per person, $50,000 of bodily injury coverage per accident, and $15,000 of property damage coverage.

Second, if you have a lien on your G5, almost all lenders will have a requirement that you buy full coverage to protect their interest in the vehicle. If coverage lapses or is canceled, the bank may buy a policy for your Pontiac at a significantly higher premium and require you to reimburse them for the expensive policy.

Third, insurance protects your Pontiac G5 and your assets. Insurance will pay for medical bills for both you and anyone you injure as the result of an accident. One of the most valuable coverages, liability insurance, will also pay for a defense attorney if you are sued as the result of an accident. If your vehicle suffers damage from an accident or hail, collision and comprehensive coverages will cover the repair costs.

The benefits of buying insurance greatly outweigh the cost, particularly if you ever have a claim. Today the average American driver is overpaying more than $810 a year so compare rate quotes once a year at a minimum to ensure rates are inline.

Smart Consumers Save on Insurance

The best way to find cheaper car insurance is to take a look at some of the factors that come into play when calculating the price you pay for car insurance. If you have a feel for what determines premiums, this allows you to make educated decisions that will entitle you to cheaper rates.

- Avoid tickets and save – Whether or not you get tickets has a lot to do with how much you pay for insurance. Good drivers pay less for auto insurance than their less careful counterparts. Just one speeding ticket or other violation can increase rates substantially. Drivers who get multiple tickets such as DWI, reckless driving or hit and run convictions might be required by their state to file a proof of financial responsibility form (SR-22) to the state department of motor vehicles in order to legally drive a vehicle.

- Policy add-ons add up – Insurance companies have many extra coverages that you can buy on your car insurance policy. Insurance for vanishing deductibles, better glass coverage, and extra life insurance coverage are probably not needed. They may seem like a good idea when talking to your agent, but if you’ve never needed them in the past get rid of them and save.

- Higher rates for coverage lapses – Having a lapse in insurance coverage can be a quick way to trigger a rate increase. In addition to paying higher rates, not being able to provide proof of insurance may result in a revoked license or a big fine. You could then be forced to prove you have insurance by filing a SR-22 with the Tennessee motor vehicle department to get your license reinstated.

- A good credit score can save money – Having a good credit score can be an important factor in calculating your car insurance rates. So if your credit history is low, you could potentially save money when insuring your Pontiac G5 by improving your rating. Insureds with good credit tend to file fewer claims and have better driving records than those with lower credit ratings.

- Cheaper premiums using alarms and GPS tracking – Buying a car with a theft deterrent system can get you a discount on your car insurance. Theft prevention features such as GM’s OnStar, tamper alarm systems and vehicle immobilizers all aid in stopping auto theft.

- Vehicle risk influences premiums – The make and model of the car, truck or SUV you drive makes a big difference in your rates. Small economy passenger cars usually have the lowest premiums, but there are many factors that impact the final cost.

When do I need an agent’s advice?

Keep in mind that when it comes to choosing insurance from an agent or online for your vehicles, there really isn’t a “best” method to buy coverage. Every situation is different so your insurance needs to address that.

For instance, these questions might help in determining if your situation might need professional guidance.

- Do I need added coverage for expensive stereo equipment?

- Do I have ACV or replacement cost coverage?

- Do I need PIP (personal injury protection) coverage in Tennessee?

- Should I rate my vehicle as business use?

- Can I drive in Mexico and have coverage?

- Can I rent a car in Mexico?

- Are all vehicle passengers covered by medical payments coverage?

- Am I covered when driving someone else’s vehicle?

If you can’t answer these questions, then you may want to think about talking to an agent. If you don’t have a local agent, take a second and complete this form or click here for a list of auto insurance companies in your area.

Memphis car insurance companies

Picking the highest-rated car insurance provider can be difficult considering how many different insurance companies sell coverage in Memphis. The information shown next can help you decide which auto insurers you want to consider when comparing rates.

Top 10 Memphis Car Insurance Companies Overall

- Travelers

- USAA

- Mercury Insurance

- AAA Insurance

- Nationwide

- Allstate

- State Farm

- The Hartford

- Safeco Insurance

- Progressive

How much can you save?

When getting Memphis auto insurance quotes online, it’s very important that you do not skimp on critical coverages to save a buck or two. Too many times, someone dropped physical damage coverage only to discover later that the savings was not a smart move. Your aim should be to get the best coverage possible at the best price, but do not sacrifice coverage to save money.

We’ve covered many tips how you can save on Pontiac G5 insurance in Memphis. The key thing to remember is the more price quotes you have, the higher the chance of saving money. Consumers may even find the best premium rates are with the least-expected company. They may often insure only within specific states and give better rates compared to the large companies like GEICO and State Farm.

To learn more, take a look at the resources below:

- Anti-Lock Brake FAQ (iihs.org)

- What Car Insurance is Cheapest for Immigrants in Memphis? (FAQ)

- Who Has Affordable Memphis Car Insurance for a Hyundai Elantra? (FAQ)

- Prom Night Tips for Teen Drivers (State Farm)

- Collision Coverage (Liberty Mutual)

- Eight Auto Insurance Myths (Insurance Information Institute)